This change is effective from year of assessment 2014 meaning employees under MTD as final tax plan who have been submitting. Step 5 Determine the Monthly Tax Deduction for the current month which shall be paid.

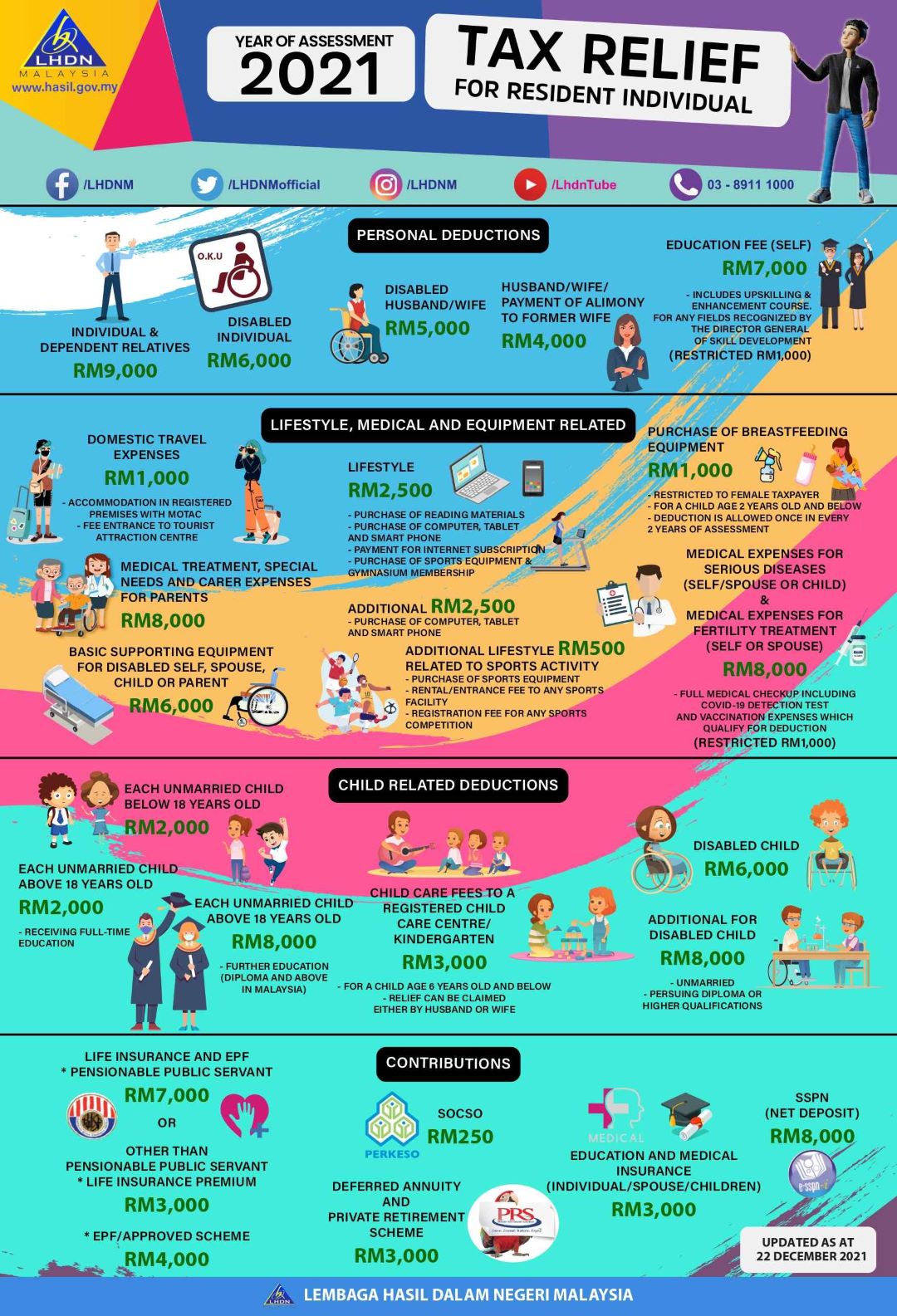

Malaysia Personal Income Tax Relief 2022

All married couples have the option of filing individually or jointly.

. As a general rule of. Jan 1 Dec 31. As of 2014 Malaysians no longer need to submit tax returns and can use Monthly Tax Deduction as their final tax payment.

Calculation method of Monthly Tax Deduction MTD 2022 are as follows. With a separate assessment both husband. Accountants and Business Consultants.

Employers responsibilities under the Monthly Tax Deduction MTD Rules are as follows. This is mandatory in that neither the employer nor employee has any choice in the matter. INCREASE OF TAX RELIEF FOR UP-SKILLING AND SELF-ENHANCEMENT COURSE FEE Current Treatment The current provision allows for tax relief in the calculation of income tax for resident individuals for tuition fees spent on attending up-skilling or self-enhancement courses.

Manual payments can be made by the employer though the submission of Forms CP39 or CP39A at the payment counter of the Inland Revenue Board of Malaysia. For persons generating employment income consisting only of cash pay MTD as a final tax was implemented with. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes.

RM - Monthly Tax Deduction PCB. What is a Monthly Tax Deduction MTD. Malaysia Monthly Salary After Tax Calculator 2020.

Regardless of whether you are an employee or employer the next article will surely be useful to you. MTD of such employee must be made under the Income Tax Deduction from Remuneration Rules 1994. What is monthly tax deduction Malaysia.

The acronym is popularly known for monthly tax deduction among many Malaysians. The employer or the company in question will then remit the amount deducted from the salary to the Inland Revenue Board by no later than the 10 th day of the following month. If the PCB amount after zakat deduction is less than RM 10 the employer needs to carry out the Monthly Tax Deduction for the employee to LHDN.

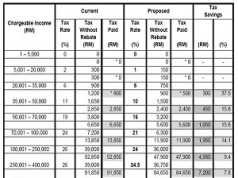

Identify the different formulas to calculate PCB for different employees. Monthly Tax Deduction MTD or PCB Potongan Cukai Bulanan was introduced in January 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the PCB deduction schedule. Flat rate on all taxable income.

Whasme - Monitoring your WhatsApp link. A simplified payroll calculator to calculate your scheduled Monthly Tax Deduction aka Potongan Cukai Berjadual. Now that you know what Malaysias Monthly Tax Deduction MTDPCB is all about the next article Part 2 of 3 will show you how to calculate it and how contributions are made from your monthly salary.

Home Employers responsibilities on monthly tax deduction PCB in Malaysia. Income Tax Rates and Thresholds Annual Tax Rate. Employer Employee Sub-Total - EPF Contribution.

Monthly Tax Deduction MTD is a system that requires an employer to deduct individual income tax from the wages and salaries of its employees at the point of receipt of the wages and salaries. Hence any PCB amount or PCB before zakat deduction below RM 10 should reflect RM 0. PCB is deducted from the employees salary and it is the employers responsibility to ensure that the necessary amount is deducted accordingly.

By Imogen McKenzie. Monthly Tax Deduction PCB and Payroll Calculator Tips Calculator based on Malaysian income tax rates for 2019. Monthly Tax Deduction for additional remuneration for the current month Total tax for a year Step 3 total Monthly Tax Deduction for a year Step 1 zakat which has been paid.

Calculate monthly tax deduction 2022 for Malaysia Tax Residents. PCB stands for Potongan Cukai Berjadual in Malaysia national language. Original photocopied or computer-generated forms are also acceptable.

There are several options to pay Monthly Tax Deductions MTD to the Inland Revenue Board of Malaysia. Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia. Deduct the MTD from the remuneration of employee in each month or the relevant month in accordance with the Schedule of Monthly Tax Deductions or Computerised Calculation Method and pay to the Director General.

Malaysia Non-Residents Income Tax Tables in 2022. This is mandatory in that neither the employer nor employee has any choice in the matter. Monthly Tax Deduction MTD or PCB Potongan Cukai Bulanan was introduced in January 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the PCB deduction schedule.

Such employee must serve under the same employer for a period of 12 months in a calendar year ie.

Pdf Compliance Cost Under The Monthly Tax Deduction Mtd Scheme For Smes In Malaysia Corresponding Semantic Scholar

Cukai Pendapatan How To File Income Tax In Malaysia

How Does Monthly Tax Deduction Work In Malaysia

Monthly Tax Deduction Pcb Calculator Mypf My

How Does Monthly Tax Deduction Mtd Pcb Work In Malaysia

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Malaysian Bonus Tax Calculations Mypf My

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Updated Guide On Donations And Gifts Tax Deductions

Pdf Compliance Cost Under The Monthly Tax Deduction Mtd Scheme For Smes In Malaysia Corresponding Semantic Scholar

Malaysian Bonus Tax Calculations Mypf My

Pdf Compliance Cost Under The Monthly Tax Deduction Mtd Scheme For Smes In Malaysia Corresponding Semantic Scholar

Should I Pay Extra Income Tax If I M Paying Monthly Tax Deduction Mtd

Pdf Compliance Cost Under The Monthly Tax Deduction Mtd Scheme For Smes In Malaysia Corresponding Semantic Scholar

7 Tips To File Malaysian Income Tax For Beginners

Do I Still Need To Pay Tax If I Am Paying Pcb Every Month Tax Updates Budget Business News